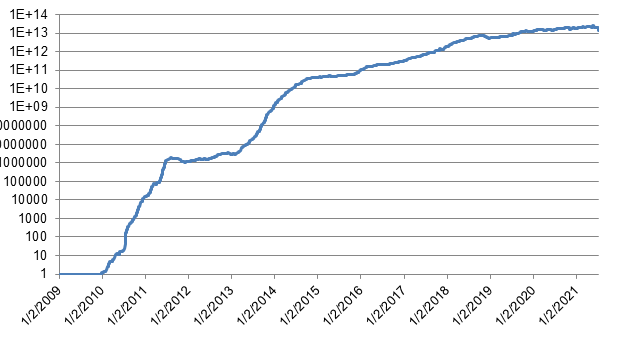

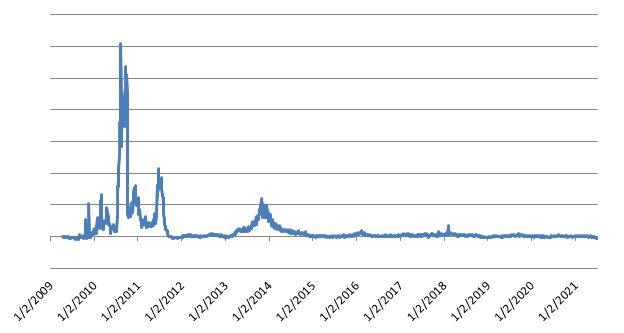

Figure 1 Bitcoin hashrate over time (log scale)

Figure 1 Bitcoin hashrate over time (log scale)

The recent China crackdown on crypto mining and its impact on the Bitcoin hashrate has sparked significant discussion in the crypto community. But what exactly is the Bitcoin hashrate? In this article, we first dive into what the hashrate represents, analyzing data to highlight its key characteristics and how it has evolved over time. Next, we explore how changes in the hashrate affect the profitability of crypto mining operations, emphasizing the importance for miners to monitor it closely and consider hedging hashrate risks with customized contracts or the support of a seasoned crypto asset manager. The article concludes with key takeaways to summarize the insights.

Bitcoin Hash Rate

What is the Bitcoin Hash Rate?

The Bitcoin hashrate represents the total computational power used by miners in the Bitcoin network, measured in hashes per second. It reflects the number of hash calculations performed by all miners over a specific period.

To process transactions on the Bitcoin blockchain, miners must perform extensive calculations to validate blocks. This involves computing hashes on a block's header, and the first miner to successfully compute the correct hash earns a reward in Bitcoin. This reward incentivizes miners to invest in the necessary infrastructure and cover their operational and fixed costs, ensuring the network remains secure and efficient

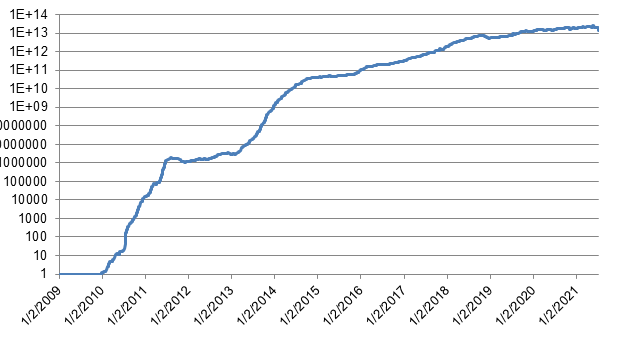

Figure 1 Bitcoin hashrate over time (log scale)

Figure 1 Bitcoin hashrate over time (log scale)

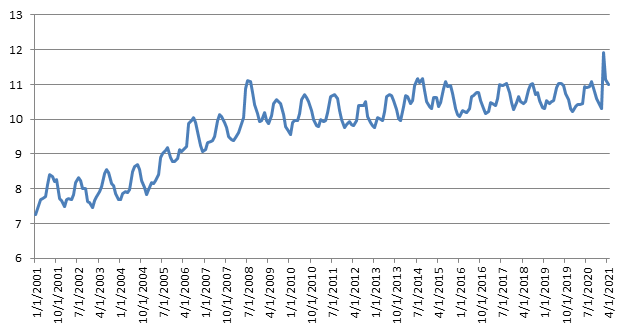

Figure 1 illustrates the Bitcoin hashrate's progression since 2009. Over the years, the hashrate has shown positive growth, albeit at a slowing pace. This trend may result from the increasing number of professional competitors, which reduces profitability for individual miners and makes mining a less lucrative endeavor. Another significant factor is Bitcoin halving, a process that occurs approximately every four years, cutting the Bitcoin reward for block validation in half. This mechanism, explored in more detail later in the article, plays a key role in shaping the mining landscape.

How is the Bitcoin Hashrate Measured?

The Bitcoin hashrate is quantified in hashes per second (H/s), with the current rate at approximately 93 exahashes per second (EH/s), where 1 EH equals 101810^{18} hashes. The hashrate’s magnitude is determined by the number of active miners in the network and the computational capacity of their equipment. Table 1 below highlights commonly used units for measuring the hashrate.

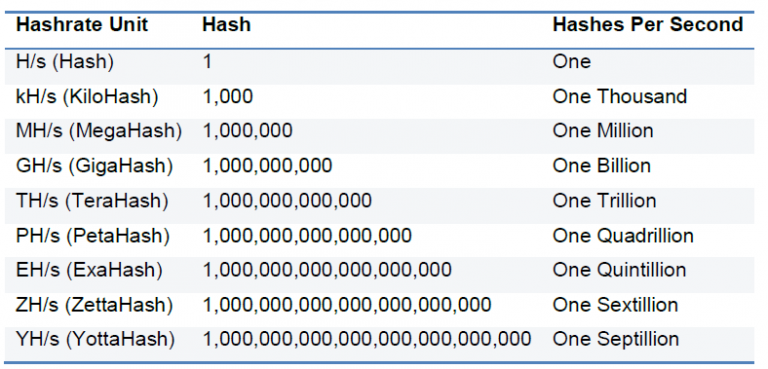

Table 1 Units of measure of the Bitcoin hashrate

Table 1 Units of measure of the Bitcoin hashrate

Mining Difficulty

To determine if a hash guessed by a miner is correct, the miner must check if the hash value is lower than a positive number called the nonce. The nonce represents the network's difficulty in validating a block. A higher nonce makes it easier to find a lower number, while a lower nonce increases the challenge.

The network adjusts its difficulty every 2016 blocks (approximately every two weeks) to maintain an average block validation time of around 10 minutes. This ensures that the number of Bitcoins awarded to miners remains approximately constant over time, regardless of fluctuations in the number of miners. Since anyone can participate in mining without restrictions, the number of miners is an uncontrollable variable. To address this, the Bitcoin network automatically adjusts the difficulty by modifying the nonce. This adjustment occurs over multiple blocks to account for permanent changes in the mining landscape.

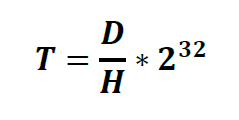

The relationship governing this process can be summarized by the following formula:

Where:

T = time to process 1 block on the Bitcoin network (approximately 10 minutes on average)

D = difficulty of the network

H = hashrate,

The hashrate is directly proportional to the number of miners in the network and the computational power of each miner. As shown in the previous formula, an increase in the network hashrate leads to a corresponding increase in difficulty to maintain a constant average block processing time.

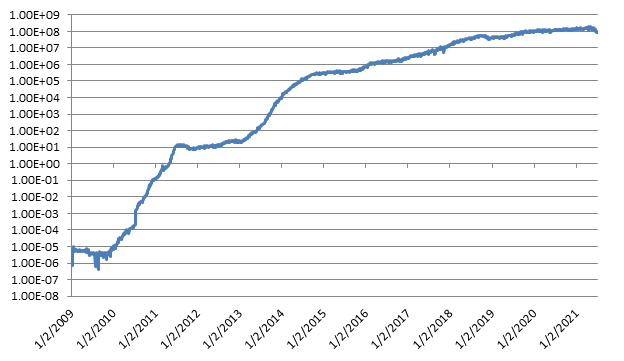

Figure 2 Bitcoin network difficulty over time (log scale)

Figure 2 Bitcoin network difficulty over time (log scale)

Figure 2 shows the Bitcoin network difficulty over time. As expected from the previous formula, it proportional to the network hashrate, with a correlation ratio of 0.99. This is done to keep the average verification time constant.

Bitcoin Network Transaction Processing Times

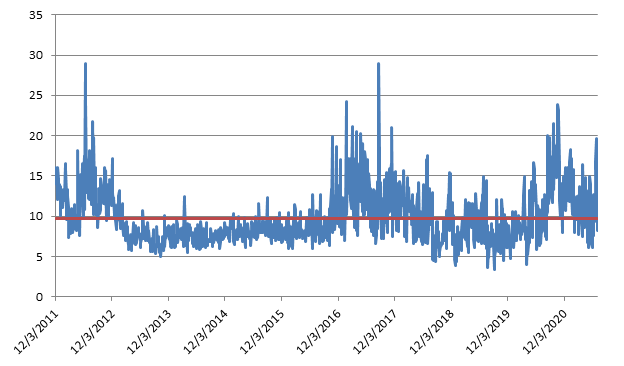

Figure 3 Bitcoin network median block processing time

Figure 3 Bitcoin network median block processing time

Block Processing Time and Hashrate Fluctuations

Figure 3 illustrates the median time to process a block on the Bitcoin blockchain, with a long-term average of approximately 10 minutes. However, there are periods when processing times are significantly longer. These deviations are caused by a combination of factors, including increased network congestion due to higher transaction volumes, reduced hashrate from miners exiting the network, and delayed difficulty adjustments that fail to immediately account for these changes.

A clear example is the recent crackdown on Bitcoin mining in China, which led to a 50% drop in the network’s hashrate. This caused temporary increases in block processing times and corresponding decreases in mining difficulty to re-stabilize the network.

Bitcoin Network Security

A higher hashrate enhances the security of the Bitcoin blockchain. With miners having limited capital for mining operations, the hashrate typically reflects the number of miners participating. Assuming miners act independently and without collusion, the likelihood of a 51% attack—where one entity gains majority control of the network and manipulates transactions—is significantly reduced with a higher hashrate. This ensures the blockchain remains secure and trustworthy.

Bitcoin Halving

Bitcoin halving is a mechanism designed to limit the supply of Bitcoin by reducing miner rewards. Every 210,000 blocks (approximately every four years), the reward for mining a block is halved. This feature is critical to maintaining Bitcoin's capped supply.

For miners, halving directly impacts revenues by cutting the Bitcoin reward in half. Theoretically, as Bitcoin’s supply decreases, its price in USD should rise if demand remains constant, helping to offset the reduction in mining rewards. Historical trends can offer insights into whether this price increase has consistently compensated for the reduced rewards over the years.

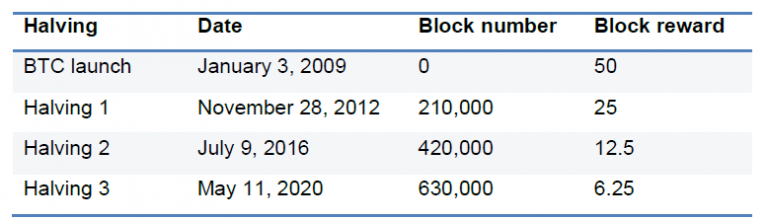

Table 2 Bitcoin halving dates

Table 2 Bitcoin halving dates

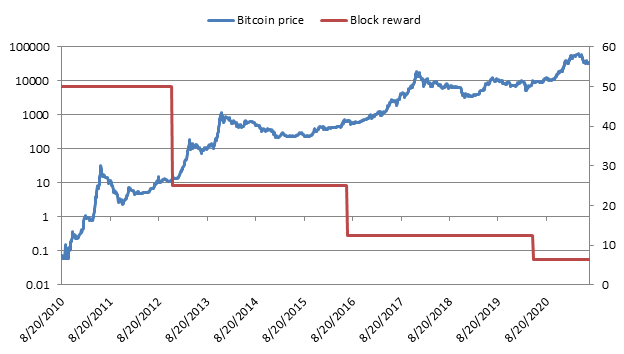

Figure 4 Bitcoin price vs block reward

Figure 4 Bitcoin price vs block reward

Table 2 shows the history of the Bitcoin halving dates happened so far, while Figure 4 shows the Bitcoin block rewards together with the corresponding Bitcoin price. As we can see from it, it seems that there is an increase in price in Bitcoin every time there is a halving. This is consistent with what we predicted before due to the reduction in the supply of Bitcoin and the amount that miners can sell in the market.

Bitcoin Mining Profit Analysis and Optimal Hedging Strategy

Having previously explored the concept of the Bitcoin hashrate, we now focus on its implications for miners. The hashrate reflects the level of competition among miners, as the total Bitcoin produced over a given period is maintained at a relatively constant rate by the blockchain's algorithms.

To analyze mining profitability, we can break it down into two components: revenues and costs. For this discussion, we assume that miners aim to maximize their profitability in USD, as their fixed and recurring expenses, such as electricity and equipment costs, are typically denominated in fiat currency. This relationship can be expressed as follows:

Where:

π(t) = profit of the Bitcoin mining operation in USD

R(t) = revenues of the Bitcoin mining operation in USD

C(t) = total cost of the Bitcoin mining operation in USD

In the next sections we analyze each component in more detail, with the corresponding risk for the miner, and determine the optimal hedging strategy.

Bitcoin Mining Revenues

Bitcoin annual mining revenues in USD are determined by the amount of Bitcoin earned over the year, multiplied by the price of Bitcoin. Assuming that the miner earns a constant amount of Bitcoin each day, and that he sells or hedge immediately them as soon as they are earned, we have the following relationship:

Where:

Rt) = Bitcoin miner revenue on day t in USD

p(t) = BTC/USD exchange rate on day t

q(t) = quantity of Bitcoin earned by the miner on day t

In addition, the quantity earned by the miner is proportional to how powerful is mining rig is, and the total amount of mining competition in the Bitcoin network. This can be expressed as:

Where:

MH(t) = miner hashrate

NH(t) = Bitcoin network hashrate

Combining the previous terms, we have the following expression giving the revenues of a Bitcoin miner on a given day:

Bitcoin miner revenues on any given day are influenced by two key external factors: the price of Bitcoin and the total network hashrate. To minimize revenue risk in USD terms, miners must assess the volatility of these factors, determine their risk tolerance, and implement an effective hedging program to mitigate potential losses. This approach helps ensure greater financial stability in an unpredictable market environment.

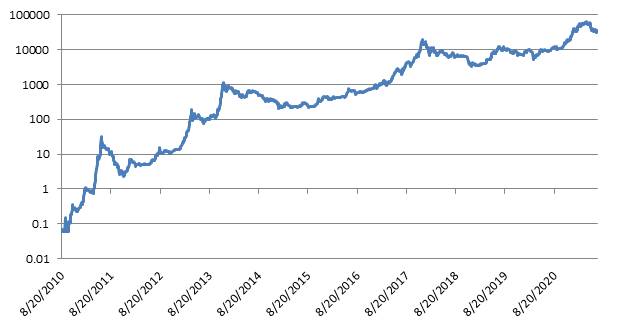

Figure 5 Price of Bitcoin over time (log scale)

Figure 5 Price of Bitcoin over time (log scale)

Figure 5 shows the price of Bitcoin since 2010. As we can see from it, Bitcoin is very volatile, with an average volatility of around 150%. Leaving a Bitcoin earning unhedged in USD terms it would therefore be too much even for the most risk tolerant miner. It is in fact so risky that he may even not be able to pay its variable costs denominated in USD terms or other fiat currency. It is therefore important that the Bitcoin miner devises a customized hedging strategy with a professional crypto asset manager to reduce its revenue risk due to the price of Bitcoin.

Figure 6 Monthly growth in the Bitcoin hashrate

Figure 6 Monthly growth in the Bitcoin hashrate

Figure 6 illustrates the historical monthly growth of the Bitcoin network hashrate since its inception. Historically, the hashrate has grown steadily at a median rate of 37% per month, reflecting increasing mining competition. This consistent growth reduces the amount of Bitcoin an individual miner can earn unless they expand their mining capacity.

While hashrate risk is less volatile and more predictable than price risk, it still significantly impacts miner profitability. Over time, this can negatively affect the long-term sustainability of mining operations. To mitigate this, a well-structured hashrate hedging program is essential to minimize associated risks and protect revenues.

Bitcoin mining hashrate hedging options

There are currently 3 main ways to reduce the hashrate revenue risk for a miner:

Mining Costs

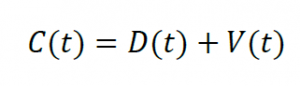

After analyzing the Bitcoin miner revenues, we now turn our attention to the other side of the equation, or the costs. Mining costs can be broken down into the depreciation cost of the initial fixed capital investment, and variable operational costs to keep the mining operation running. In other words, we have the following:

Where:

C(t) = total Bitcoin mining cost in period t

D(t) = depreciation cost mining equipment in period t

V(t) = variable operational mining expenses in period t

The previous 2 costs are contrasting, since an initial investment in higher capacity and modern equipment will most likely result in lower energy consumption. Assuming that the it is optimal for the miner to buy the latest mining technology available on the market because of the gain in efficiency and reliability it can provide, the main focus will then be on the variable running costs.

Bitcoin mining rigs are made by ASIC equipment that is optimized for computing hashing operations very quickly and efficiently specifically for Bitcoin. They work by consuming electricity and producing heat and hashes outputs. Their capacity is given by their hashrate and is measured in hashes per seconds. A current Bitcoin ASIC miner has a hashrate of about H/s.

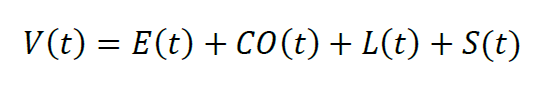

When considering the running costs of operating these miners, the main factors we need to consider are the electricity, cooling, labor, and storage costs. This is summarized as follows:

Where:

V(t) = total variable costs at time t

E(t) = electricity costs at time t

CO(t) = cooling costs at time t

L(t) = labor costs at time t

S(t) = storage costs at time t

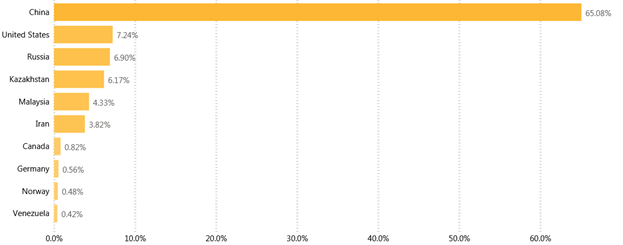

Among the various costs associated with Bitcoin mining, electricity is typically the largest and most critical. Mining equipment operates continuously, consuming significant amounts of energy 24/7. Additionally, variable mining costs, including electricity, depend heavily on the location of the mining operation. Therefore, conducting a comprehensive business plan and feasibility analysis is crucial to ensure the miner selects an optimal location globally, considering their specific constraints and operational requirements. Figure 7 Bitcoin network hashrate global distribution (source: Cambridge Centre for Alternative Finance)

Figure 7 Bitcoin network hashrate global distribution (source: Cambridge Centre for Alternative Finance)

Figure 7 shows the distribution of the Bitcoin network hashrate around the world as of Q2 of 2020. As we can see from it and as reflected by recent data in hashrate drop of about 50%, most of the mining facilities were operating in China, followed by the United States and Russia.

This is mostly likely due to the previous considerations in terms of operational costs, technological advances, and a general interest in the crypto space in the previous countries. Following the recent China crackdown on mining from regulators, we expect that the US will occupy a much bigger share of mining operations for the reasons previously considered.

Having understood that electricity is the most relevant variable cost in a Bitcoin mining operation, it is now important to see its volatility and if a miner can reduce the risk in his profits by hedging it. For simplicity and availability of public data, we will use the United States as the place of reference.

Figure 8 Commercial price of electricity over time in the United States

Figure 8 Commercial price of electricity over time in the United States

Figure 8 shows the commercial price of electricity over time in the US since 2001. As the figure shows, there is some slight upward constant trend and a seasonality component over the course of the year. Based on the previous data, electricity prices seem quite stable over the course of the year, and it is therefore not necessary for a miner to hedge them. The most important decision remains then at the beginning to locate the most optimal region providing the lowest operating variable costs, including electricity.

Optimal Bitcoin Miner Hedging Strategy

After analyzing both revenues and costs, the following key conclusions can be drawn for an effective Bitcoin miner hedging strategy:

Bitcoin Price Risk:

The price of Bitcoin is the primary factor affecting miner revenue. Since miners earn revenue in BTC but incur costs in USD, it is crucial to evaluate and manage the risk posed by Bitcoin price volatility.Hashrate Impact:

The Bitcoin hashrate directly influences miner revenue by determining the level of competition. While its impact is less significant than the Bitcoin price, miners must account for the effect of network growth on their profitability.Electricity Costs:

Electricity, though a major component of operational costs, tends to remain stable over time. As a result, it typically does not require specific hedging.Comprehensive Hedging Program:

To ensure long-term sustainability and profitability, miners need an effective hedging strategy tailored to their specific risks, such as Bitcoin price fluctuations and network hashrate changes. Partnering with a reputable crypto asset manager can help miners develop customized hedging solutions, reducing economic risks and driving long-term success for their operations.

Let’s talk.

This website is not an offer to, or solicitation of, any potential clients or investors for the provision by Apex Hedgefund, INC of investment management, advisory, or any other related services. No material listed on this website is or should be construed as investment advice, nor is anything on this website an offer to sell, or a solicitation of an offer to buy, any security or other instrument. The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. There is no guarantee that our investment products will deliver the expected returns. There in no guarantee that our risk management framework will be successful in preventing losses to occur or will be effective in managing all types of risks. Past performance is not necessarily indicative of future results.

Links from this website to third-party websites do not imply any endorsement by the third party of this website or of the link, nor do they imply any endorsement by this firm of the third-party website or of the link.